property purchase tax in france

If you are renting out a French property the net income will be taxed at the scale rates of income tax ranging from 11 for income over 10084 to 45 income over 158122 in 2021 plus 172 social charges. The largest portion of the fee is the droits denregistrment which is like Frances stamp duty ie a tax on property purchases.

Wherever You Go Real Estate Holds A Distinctive Role In Shaping Up A Country S Economy Directly Affecting The Buyers And Sellers In The Market There Are Some

Properties over five years old are charged at 58 though a few are charged at 508.

. The property market is also forecast to rebound strongly post-Covid and house prices are predicted to increase by 35 across France in 2021. The Legal Fees. As a general rule real estate in France is subject to French local taxes.

One- to two-bedroom apartments from around 100000. There are a number of automatic calculators on-line that can be used to obtain an estimate of the fees taxes and other charges for which you will be liable. The legal fees are called frais de Notaires or notary fees they are usually around 6-7 of the net selling price and include the stamp duty.

The amount of registration fees included is 580 of the purchase price and in some departments 509. If you occupy the property you own you will be subject to. The tax-free allowance is 800000 after that rates start at 05 and rise progressively up to 15.

Although house prices have been rising in France they are still 10 below their 2006 high-point. This is usually around 5 of the propertys value. Some homes are sold TTC toutes tax.

There are various tax regimes for French rental. The first-year reduction of 30 per cent applies to. A typical property purchase in France will incur combined charges from a notaire and estate agent of between ten and fifteen percent of the final purchase price.

Existing Property - between 7 and 10 of the purchase price excluding estate agency fees. In a very small number a lower rate of 509 applies. Three-bedroom houses from around 300000.

In the case of the purchase of an old property the total transfer of ownership costs and taxes payable for the purchase of an existing property is between 7 and 10 of the purchase price excluding real estate agency fees. First is the French property tax taxes foncières which is due by the owner of the property. The fee usually comes to approximately 7 of the purchase price but it can vary very slightly from area to area and property value etc.

The second one is French housing tax taxe dhabitation which is due by the tenant of the property. Buying together with family is not uncommon in France and is a great way to double quadruple or triple your purchasing power. Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary residence.

There is an 800000 tax. In total the sum of fees involved in buying the house cant exceed 10 of the propertys value. If you are leasing your property to a professional management.

Estate agent fees when not paid by the seller - 5-8. Depending on when you purchase a property in France and your personal circumstances you may benefit from the French governments plans to phase out of the taxe dhabitation which began in January 2018. There is some variation in the level of the taxes depending on the department in which the property is situated.

Non-residents are liable on French real estate including any rights over property situated in France. Real estate assets whose net worth on January 1 is less than this amount is therefore not subject. Mortgage fees if using a French bank - 1.

Calculating Fees and Taxes for Buying Property in France. You can easily estimate the notaire fees will be with our handy legal fees calculator. RecentNew Property Developments - 2 in conveyancing fees and registration taxes plus VAT at the rate of 20 on the purchase price except for sales between private individuals excluding estate agency fees.

Broadly speaking there are two main categories of French property taxes you need to know about - sales taxes and maintenance taxes. Ad 100000 properties in France fully translated in English. Fees and charges to consider when buying property in France.

However youll only pay wealth tax if your total taxable property assets are worth 13 million or more. Newer homes are charged at 07 plus 20 VAT. Real estate rights and property in France.

The French taxe foncière is an annual property ownership tax which is payable in October every year. They are not always up to date with their rates nor entirely comprehensive but the most reliable one can be found on the. The same applies to French residents who rent out property abroad.

The taxe foncière and taxe dhabitation are both typically around 10 - 20 euros per m2 per year each. The notaire will oversee all aspects of the sale to ensure all applicable laws are adhered to and all taxes are paid in full. Non-residents of France may also have a wealth tax liability but only on their French property assets.

The initial purchase of a property in France will incur various fees and taxes. This is payable at the end of each year in December and can also be paid monthly. In the overwhelming majority of departments the taxes amount to 580 of the purchase price.

Youll also need to pay stamp duty when buying a house in France. Find out how by. In most countries property tax refers to any tax concerning real estate.

Impôt sur la Fortune Immobilière IFI is an annual wealth tax on property in France. Stamp duty Droit de mutation - 58. The taxe foncière is used to fund local services within the.

The property market in France has been surprisingly resilient to the Covid-19 pandemic. Taxe dhabitation is a residence tax. These are called frais dagence in french and remember that the.

These taxes are based on the cadastral value of the property. If you are a non-resident in France your taxable assets consist of. You have to pay this tax if you own a property and live in it yourself have it available for your use or rent it out on.

Heres a summary of the kinds of costs you can expect to pay when buying property in France ⁷. The notaire can advise you on the rate in your department. Because the notary will calculate and charge all the relevant taxes during the purchase process you will not generally be aware of them as separate categoriesThe total taxes and fees can add up to as much as 20 of the price of a property depending on whether the agents fees are paid by buyer or seller.

What is property tax in France¹. Sales taxes are the ones you encounter when buying or selling property. The rates of tax are set by the région the département and the commune and vary from one district to another.

The Wealth tax kicks in for French households whose combined worldwide assets are valued at more than 1 300 000 Euros on 1st January 2022. It is payable by the individual who owns the property on the 1st January of the same year and is applicable whether you live in your property or rent it out.

French Taxes I Buy A Property In France What Taxes Should I Pay

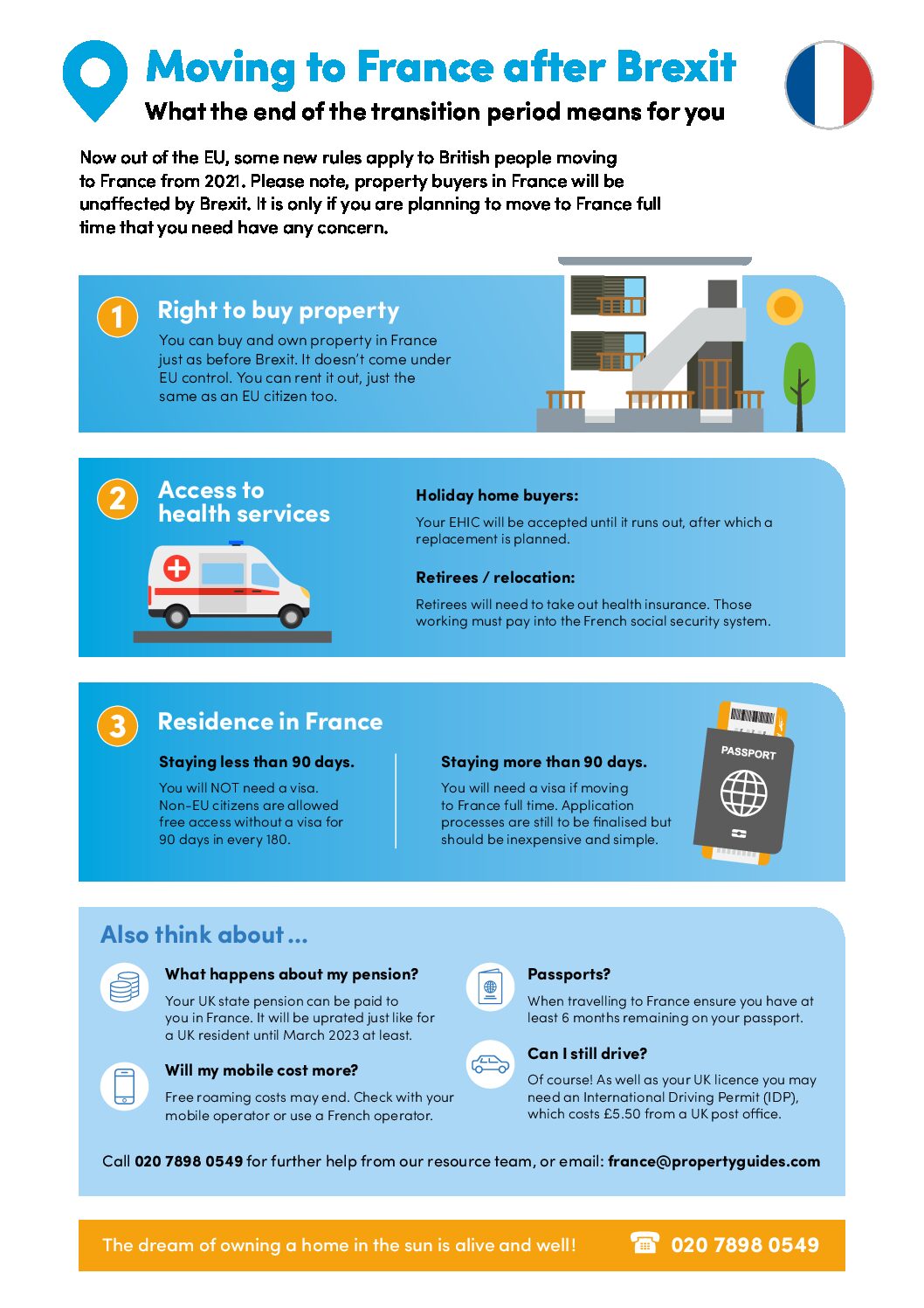

Buying Property In France After Brexit France Property Guides

Legally Binding Contract Template Lovely Legally Binding Contract Terms Examples Loan Agreement Contract Template Marketing Plan Template Contract

In Depth Guide To French Property Taxes For Non Residents Expats

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum

French Taxes I Buy A Property In France What Taxes Should I Pay

French Property Prices Analysis Of The Market Notaries Of France

The Gasur Map A Cuneiform Tablet Detailing A Land Purchase Dated To 2360 2150 Bce The Hittities Had A Sort Of Land Tax Called Map Biblical Studies Archaeology

Real Estate Marketing Flyers Real Estate Flyers Real Estate Marketing

French Property Tax Considerations Blevins Franks

1031 Exchange Tips Hauseit Capital Gains Tax Real Estate Terms Capital Gain

Tax Implications For Foreign Nationals Buying Property In The U S New York Casas

Like Kind Exchanges Of Real Property Journal Of Accountancy

French Taxes I Buy A Property In France What Taxes Should I Pay